Reserve pelo nosso site e garanta o melhor preço online!

Lazúli Hotel Itatiba

O Lazúli Hotel é uma excelente opção de hospedagem em Itatiba.

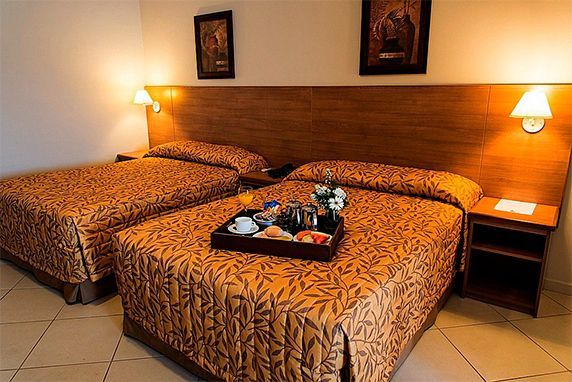

Sua localização privilegiada, junto ao completo de serviços Morro Azul, proporciona aos hóspedes praticidade e conforto, pois reúne diversos serviços essenciais em um só lugar. O hotel está também a 1,8 Km do Zooparque Itatiba, com descontos especiais para hóspedes e a diária incluí delicioso café da manhã, estacionamento e wifi. Apartamentos amplos, confortáveis e totalmente equipados.

Por que escolher

o Lazúli Hotel?

Hospitalidade, eficiência e conforto...nossa maneira de hospedar!

Avaliações dos Hóspedes

Muito bom, lugar limpo, bem cuidado, funcionários educados, atenciosos . Café da manhã bom , quartos bem arrumadinhos, limpos. Tudo excelente!

Bruna Gouveia

O hotel fica bem localizado, ao lado da BR e com um posto com restaurante e um Starbucks, servindo ótimas opções de jantar. os quartos são aconchegantes e bem limpos, e o atendimento é excepcional, tanto na recepção quanto no café da manhã. vale a pena!

Camilla M

TripAdvisor

Estadia muito boa, 3 noites. Recepcionistas são educados e atenciosos. Café da manhã espetacular. Quartos limpos com roupa de cama cheirosas. Muita limpeza. Acesso excelente com estacionamento. Foi realmente satisfatório.

Carlos e Vani

Como Chegar

Encontre facilmente o caminho até o Lazúli Hotel Itatiba com as nossas instruções detalhadas e mapa interativo.